Harry Moroz

Is the Economic Tide Coming In or Going Out?

Not to beat a dead horse, but a WSJ op-ed on Wednesday made me reflect briefly on the Bush years. Adam Lerrick, an economics professor at Carnegie Mellon and a scholar at AEI, heavily criticized Obama’s economic policy and tax plan, providing a macabre warning that “The economic tides will not stand while Washington experiments with European-type social democracy…Tomorrow’s children may come to question why their parents sold their birthright for a mess of ‘fairness’…” Indeed. Selling birthrights is downright eerie sounding.

What dangers had Lerrick identified in Obama’s economic strategy?

The sequence is always the same. High-tax, big-spending policies force the economy to lose momentum. Then growth in government spending outstrips revenues. Fiscal and trade deficits soar. Public debt, excessive taxation and unemployment follow. The central bank tries to solve the problem by printing money. International competitiveness is lost and the currency depreciates. The system stagnates. And then a frightened electorate returns conservatives to power.

Right. But what if we replaced “high-tax” and “excessive taxation” with “low tax” and “tax cuts for the wealthy”. We seem to end up with a pretty accurate description of the Bush presidency:

The sequence is always the same. [Low-tax], big-spending policies force the economy to lose momentum. Then growth in government spending outstrips revenues. Fiscal and trade deficits soar. Public debt, [tax cuts for the wealthy] and unemployment follow. The central bank tries to solve the problem by printing money. International competitiveness is lost and the currency depreciates. The system stagnates. And then a frightened electorate returns conservatives to power.

The comparison is, of course, not entirely appropriate. For one, the Bush tax cuts weren’t really a “low-tax” policy as much as they were a low-tax policy for the wealthy. For another, conservative power is, well, waning. (Also, the dollar has remained relatively strong and inflationary/deflationary pressures aren't entirely clear, at least to me.)

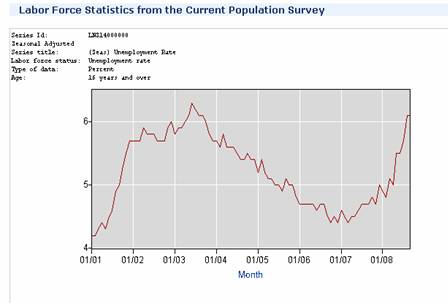

But this exercise, and the graphs below, should give anyone who buys the “tax increases will take the life of your first born” argument pause.

BLS

Treasury Department

Commerce Department

Harry Moroz: Author Bio | Other Posts

Posted at 12:33 PM, Oct 24, 2008 in

Economic Opportunity | Economy | Election 2008 | Employment | Federal Budget | Fiscal Responsibility | Trade

Permalink | Email to Friend