Harry Moroz

Health Care…I Mean…The Financial Markets Are Too Big To Fail

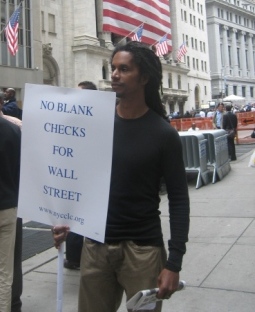

Just outside DMI’s conveniently located office in the heart of the Financial District and just a short time before agreement on an enormous Wall Street buyout was announced, union workers – with hardhats in hand, protective glasses pushed high on their heads, and boots laced up – rallied against the $700 billion plan to buy up troubled financial assets. Their slogan: “Why isn’t health care (or education or infrastructure) too big to fail?”

Just outside DMI’s conveniently located office in the heart of the Financial District and just a short time before agreement on an enormous Wall Street buyout was announced, union workers – with hardhats in hand, protective glasses pushed high on their heads, and boots laced up – rallied against the $700 billion plan to buy up troubled financial assets. Their slogan: “Why isn’t health care (or education or infrastructure) too big to fail?”

I wrote earlier this week that “Deficit hawks will doubtless bemoan any increased government spending after the Treasury Department’s costly bailout of the financial system.” Yet for now, as Robert Kuttner points out for The American Prospect, “deficit fear-mongers have gone quiet.” The implication: deficit spending – not to mention government intervention – only works when Wall Street sees red.

But Kuttner and others argue strenuously that deficit spending is not only not harmful, but quite beneficial when expended in the appropriate ways. Kuttner writes:

I have been arguing that a deficit of several hundred billion dollars spent on the right social investments will be a necessary source of stimulus, and will actually help ordinary people.

So don’t let the deficit fear-mongers scare you when they talk about the purported dangers of public spending on health care, education, renewable energy, efficient technology, and infrastructure. This is indeed exactly the type of spending our troubled economy needs. The union workers outside the New York Stock Exchange know this. Do our representatives in Washington?

So don’t let the deficit fear-mongers scare you when they talk about the purported dangers of public spending on health care, education, renewable energy, efficient technology, and infrastructure. This is indeed exactly the type of spending our troubled economy needs. The union workers outside the New York Stock Exchange know this. Do our representatives in Washington?

Harry Moroz: Author Bio | Other Posts

Posted at 4:41 PM, Sep 25, 2008 in

Financial Justice | Fiscal Responsibility | Health Care | Infrastructure

Permalink | Email to Friend